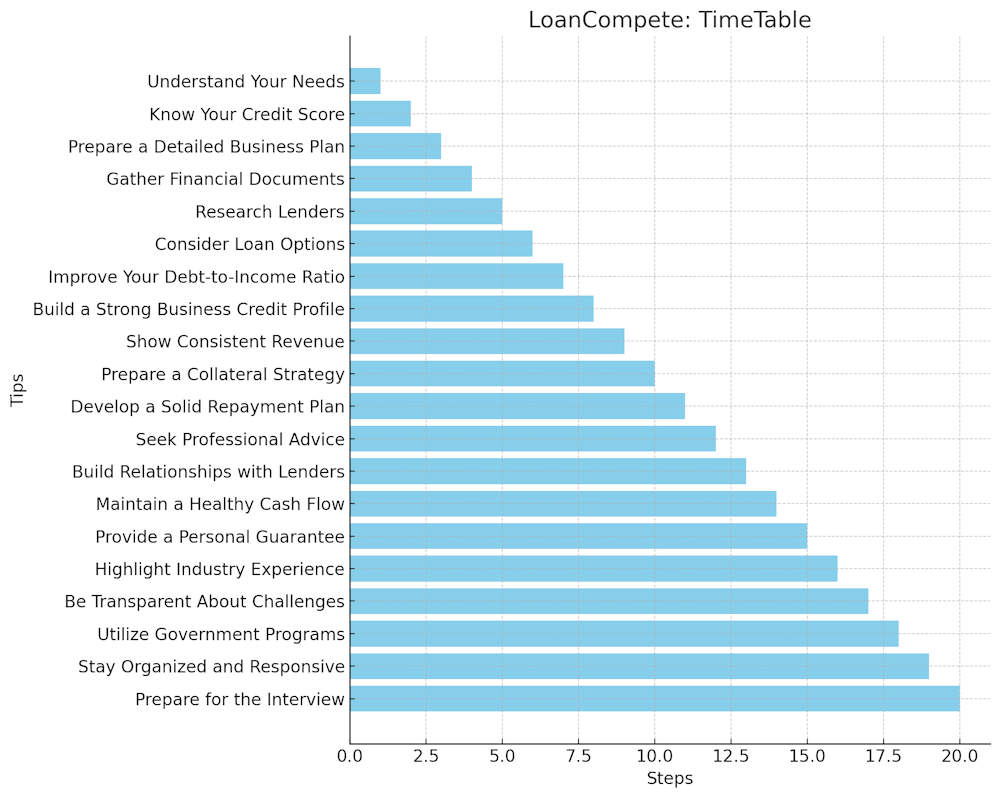

Securing a Business Loan: 20 Expert Tips

Securing a business loan can be a complex process, but with the right approach, you can significantly increase your chances of success. Whether you’re a startup or an established business, these expert tips will guide you through the steps to secure the funding you need.

1. Understand Your Needs

Before you apply for a business loan, it’s crucial to have a clear understanding of why you need the loan and how much funding you require. Define the purpose of the loan, whether it’s for expansion, inventory, working capital, or another business need. This clarity will help you determine the type of loan that best suits your requirements and present a more compelling case to lenders.

2. Know Your Credit Score

Your personal and business credit scores play a significant role in the loan approval process. Lenders use these scores to assess your creditworthiness. Obtain your credit reports from major credit bureaus and review them for any inaccuracies. If your score is low, take steps to improve it before applying for a loan. A higher credit score can lead to better loan terms and lower interest rates.

3. Prepare a Detailed Business Plan

A comprehensive business plan is essential when applying for a business loan. It should include an executive summary, business description, market analysis, organizational structure, product line or services, marketing and sales strategies, funding request, and financial projections. A well-prepared business plan demonstrates to lenders that you have a clear vision for your business and a solid strategy for success.

4. Gather Financial Documents

Lenders will require various financial documents to assess your business’s financial health. These may include income statements, balance sheets, cash flow statements, tax returns, and bank statements. Organize these documents in advance to streamline the application process. Accurate and up-to-date financial records will help build lender confidence in your ability to repay the loan.

5. Research Lenders

Not all lenders are the same, and each may have different requirements and terms. Research various types of lenders, such as traditional banks, credit unions, online lenders, and microlenders, to find the best fit for your business needs. Consider factors such as interest rates, loan terms, fees, and eligibility criteria. Building relationships with multiple lenders can also increase your chances of securing a loan.

6. Consider Loan Options

There are various types of business loans available, including term loans, lines of credit, SBA loans, equipment financing, and invoice financing. Each loan type serves different purposes and has unique advantages. Evaluate your specific needs and choose the loan option that aligns with your business goals and financial situation.

7. Improve Your Debt-to-Income Ratio

Lenders assess your debt-to-income (DTI) ratio to determine your ability to manage additional debt. A lower DTI ratio indicates better financial health and a higher capacity to repay the loan. To improve your DTI ratio, pay down existing debts and avoid taking on new liabilities before applying for a loan. A strong DTI ratio can enhance your loan application and help secure more favorable terms.

8. Build a Strong Business Credit Profile

Just like personal credit, your business credit profile is crucial for loan approval. Ensure your business is registered with the major business credit bureaus, and consistently pay your bills on time to build a positive credit history. Consider opening business credit accounts and using them responsibly. A solid business credit profile can make your business more attractive to lenders and improve your chances of securing a loan.

9. Show Consistent Revenue

Lenders want to see that your business has a steady and reliable income stream. Demonstrate consistent revenue by providing historical financial statements and sales records. Highlight any growth trends and explain any fluctuations in revenue. Consistent revenue reassures lenders that your business can generate the cash flow needed to repay the loan.

10. Prepare a Collateral Strategy

Many lenders require collateral to secure a business loan. Collateral can include assets such as real estate, equipment, inventory, or accounts receivable. Determine what assets you can use as collateral and be prepared to present their value to the lender. A strong collateral strategy can enhance your loan application and potentially result in better loan terms.

11. Develop a Solid Repayment Plan

A well-thought-out repayment plan is essential for convincing lenders of your ability to repay the loan. Detail how you plan to generate the necessary cash flow to meet your loan obligations. Include projections of future income and expenses, and demonstrate how loan repayment fits into your overall financial strategy. A solid repayment plan shows lenders that you have considered all aspects of loan management.

12. Seek Professional Advice

Navigating the loan application process can be complex, and seeking professional advice can be invaluable. Consider consulting with a financial advisor, accountant, or business mentor who can provide guidance tailored to your specific situation. They can help you prepare your financial documents, refine your business plan, and choose the best loan options. Professional advice can increase your chances of securing a loan and help you make informed financial decisions.

13. Build Relationships with Lenders

Establishing strong relationships with potential lenders can significantly improve your chances of securing a business loan. Attend networking events, join business associations, and make connections within the financial community. Building a rapport with lenders allows you to understand their expectations and can lead to more personalized loan terms.

14. Maintain a Healthy Cash Flow

Cash flow is a critical factor for lenders when evaluating your loan application. Ensure your business maintains a healthy cash flow by managing expenses, optimizing pricing strategies, and accelerating receivables. Demonstrate your ability to generate positive cash flow consistently, as this will reassure lenders of your ability to meet loan repayments.

15. Provide a Personal Guarantee

In some cases, lenders may require a personal guarantee, especially for small businesses or startups. A personal guarantee means you are personally responsible for repaying the loan if your business cannot. Offering a personal guarantee can increase your chances of loan approval, but it also puts your personal assets at risk. Carefully consider this option and discuss it with a financial advisor before proceeding.

16. Highlight Industry Experience

Your experience and expertise in your industry can play a significant role in a lender’s decision. Highlight your professional background, achievements, and any relevant industry certifications. Demonstrate how your experience equips you to manage and grow your business successfully. Lenders are more likely to approve a loan if they believe you have the knowledge and skills to achieve your business goals.

17. Be Transparent About Challenges

Honesty is crucial when dealing with lenders. Be upfront about any challenges your business has faced and how you have addressed them. Whether it’s a temporary dip in revenue or a past financial setback, transparency builds trust. Explain the steps you’ve taken to overcome these challenges and how the loan will help prevent future issues.

18. Utilize Government Programs

Explore government-backed loan programs designed to support small businesses. Programs such as the Small Business Administration (SBA) loans in the U.S. offer favorable terms and lower interest rates. Research the eligibility criteria and application process for these programs. Government-backed loans can be a valuable resource for securing the funding your business needs.

19. Stay Organized and Responsive

Throughout the loan application process, maintain organized records and be responsive to lender requests. Timely submission of required documents and prompt responses to inquiries can expedite the process and demonstrate your professionalism. Lenders appreciate applicants who are well-prepared and cooperative, which can positively influence their decision.

20. Prepare for the Interview

If your loan application progresses to an interview stage, prepare thoroughly. Review your business plan, financial statements, and repayment strategy. Be ready to answer questions about your business model, market conditions, and how you plan to use the loan funds. A confident and well-prepared interview can significantly enhance your chances of securing the loan.

19. Stay Organized and Responsive

Throughout the loan application process, maintain organized records and be responsive to lender requests. Timely submission of required documents and prompt responses to inquiries can expedite the process and demonstrate your professionalism. Lenders appreciate applicants who are well-prepared and cooperative, which can positively influence their decision.

20. Prepare for the Interview

If your loan application progresses to an interview stage, prepare thoroughly. Review your business plan, financial statements, and repayment strategy. Be ready to answer questions about your business model, market conditions, and how you plan to use the loan funds. A confident and well-prepared interview can significantly enhance your chances of securing the loan.

Securing a business loan requires careful preparation, a solid understanding of your financial situation, and effective communication with potential lenders. By following these expert tips, you can present a strong loan application and increase your chances of obtaining the funding your business needs. Remember, each step you take towards preparing and organizing your application brings you closer to achieving your business goals. Good luck on your journey to securing a business loan and driving your business to new heights!

Additional References

- U.S. Small Business Administration (SBA) – Loans & Grants

- The SBA provides detailed information on various loan programs, grants, and funding options available to small businesses.

- SCORE – Business Plan Templates and Financial Statements

- SCORE offers free business plan templates and resources to help you create a comprehensive business plan and financial statements.

- Federal Reserve – Small Business Credit Survey

- The Federal Reserve’s annual Small Business Credit Survey provides insights into the financing needs and challenges of small businesses.

- National Association of Government Guaranteed Lenders (NAGGL)

- NAGGL is a professional association that supports SBA lenders and provides resources on SBA lending programs and guidelines.

- U.S. Chamber of Commerce – Small Business Financing

- The U.S. Chamber of Commerce offers information and guides on small business financing options, including loans and government-backed programs.

Please contact us if you have any feedback or questions.