Top 15 Tips When Applying for a Small Business Loan

1. Understand Your Credit Score

Why It’s Important:

Your credit score is one of the first metrics lenders assess when evaluating your loan application. It reflects your financial responsibility and predicts how likely you are to repay the loan.

Steps to Take:

- Check Your Score: Obtain your credit report from major credit bureaus such as Experian, Equifax, and TransUnion.

- Understand Your Score: Familiarize yourself with what your score means in the context of loan applications.

- Improve Your Score: Address any outstanding debts, dispute inaccuracies in your report, and avoid opening new credit lines before applying for the loan.

Credit Score Range Insight:

Knowing whether your score is Poor (300-579), Fair (580-669), Good (670-739), Very Good (740-799), or Excellent (800-850) can guide you in understanding your standing with potential lenders.

2. Prepare a Detailed Business Plan

Why It’s Important:

A comprehensive business plan not only demonstrates your business acumen and preparedness but also reassures lenders of your commitment and the viability of your business.

Steps to Take:

- Executive Summary: Craft a concise yet compelling overview of your business.

- Market Analysis: Provide detailed insights into your industry, market trends, competitor analysis, and target demographic.

- Organizational Structure: Detail your company’s structure, leadership roles, and key personnel qualifications.

- Product/Service Line: Elucidate your offerings and their competitive advantages.

- Marketing and Sales Strategy: Outline your strategies for customer acquisition, retention, and growth.

- Financial Projections: Project your financial performance over the next 3-5 years, including profit and loss forecasts, cash flow analysis, and capital expenditure plans.

3. Gather Comprehensive Financial Documentation

Why It’s Important:

Complete and accurate financial documentation is crucial as it provides a clear picture of your business’s financial health and persuades lenders of your ability to manage business finances effectively.

Steps to Take:

- Personal and Business Tax Returns: Prepare the last two to three years of complete tax returns.

- Balance Sheet and Profit & Loss Statements: Include current and previous financial statements that show your business’s operational efficiency.

- Cash Flow Statements: Detail the inflows and outflows of cash, emphasizing how funds are managed.

- Bank Statements: Keep ready at least six months to one year of personal and business bank statements.

- Debt Schedules: Document all existing debts, terms, creditors, and maturity dates to present a transparent picture of your liabilities.

4. Showcase Your Collateral

Why It’s Important:

Offering collateral can significantly enhance your loan application, providing the lender with a security measure in case of default. It also demonstrates your commitment to the loan.

Steps to Take:

- Identify Possible Collateral: This could include business assets, real estate, inventory, or equipment.

- Appraise Your Collateral: Get a professional valuation to accurately determine the worth of your collateral.

- Document Ownership and Value: Ensure you have clear documentation proving your ownership and the current market value of the collateral.

Collateral Valuation Tips:

Seek multiple appraisals to ensure you present the most accurate value to your lender.

5. Check Eligibility Requirements

Why It’s Important:

Different lenders have varied eligibility criteria for loan approvals. Knowing and understanding these can save you time and increase your chances of a successful application.

Steps to Take:

- Research Lender Requirements: Look into several lenders’ criteria for loan approvals, which may include minimum revenue figures, years in business, and industry type.

- Pre-Qualify: Some lenders offer pre-qualification tools to assess your likelihood of approval without affecting your credit score.

- Align Application: Tailor your application to meet specific lender requirements, focusing on strengthening areas where your business excels.

Resource for Comparing Lenders:

Provide an interactive tool or database that compares different lenders’ criteria and loan terms.

6. Perfect Your Pitch

Why It’s Important:

In many cases, especially with small banks and local lenders, you’ll need to make a personal pitch. A compelling presentation can sway decisions by demonstrating your passion, preparedness, and business acumen.

Steps to Take:

- Prepare Your Materials: Include your business plan, financial forecasts, and a summary of your market analysis.

- Practice Your Pitch: Rehearse your presentation multiple times to ensure clarity and confidence.

- Highlight Key Points: Emphasize aspects like unique selling points, market opportunities, and strategic directions.

Pitch Practice Tips:

Consider recording your practice sessions to critique your delivery and make necessary adjustments.

7. Understand Loan Types and Terms

Why It’s Important:

Different types of loans are designed to meet various business needs. Understanding the specifics of each loan type, along with their terms and conditions, helps you choose the best option for your business requirements.

Steps to Take:

- Research Loan Types: Familiarize yourself with the different types of loans available, such as term loans, lines of credit, SBA loans, and equipment financing.

- Compare Interest Rates and Terms: Analyze the interest rates, repayment terms, and any associated fees for each loan type.

- Consider Loan Use: Align the type of loan you apply for with the purpose it will serve in your business, ensuring that the terms are manageable within your business’s financial framework.

8. Prepare for the Interview Process

Why It’s Important:

Many lenders conduct interviews with potential borrowers to get a better understanding of their business model and the purpose of the loan. Being well-prepared for this interview can significantly impact the outcome.

Steps to Take:

- Review Common Questions: Prepare answers for common questions such as details about your business, how you will use the loan, and your plans for repayment.

- Showcase Business Achievements: Be ready to discuss key milestones, growth metrics, and successful projects or contracts.

- Discuss Future Plans: Articulate clear and realistic future goals that demonstrate how the loan will help facilitate these plans.

9. Address Potential Red Flags

Why It’s Important:

Lenders will scrutinize your application for any indicators of risk. Proactively addressing these concerns can help mitigate their impact and reassure lenders of your reliability.

Steps to Take:

- Identify Red Flags: These might include inconsistent revenues, previous loan defaults, or recent large expenditures.

- Prepare Explanations: Be ready to explain any questionable aspects of your financial history, including the steps taken to rectify past issues.

- Demonstrate Stability: Provide evidence of recent business improvements, steady cash flow, or strategic adjustments made to enhance stability.

Risk Mitigation Strategies:

Outline strategies or steps that show how you’ve addressed these risks to improve your business’s financial health.

10. Enhance Your Online Presence

Why It’s Important:

Many lenders will research your business online as part of their due diligence. A strong, professional online presence can build credibility and showcase your business’s legitimacy and engagement.

Steps to Take:

- Update Your Website: Ensure that your business website is professional, up-to-date, and informative.

- Optimize Social Media: Maintain active and professional social media profiles that reflect your business activities and values.

- Manage Online Reviews: Encourage satisfied customers to leave positive reviews and respond professionally to any negative reviews.

11. Leverage Relationships with Local Lenders

Why It’s Important:

Building relationships with local banks and credit unions can be advantageous, as these institutions may be more flexible and willing to support local businesses compared to larger banks.

Steps to Take:

- Network Locally: Attend local business events and join business associations to meet potential lenders.

- Consider Community Banks: These banks often focus on helping local businesses thrive and may offer more personalized service.

- Build Relationships: Even if you don’t need a loan immediately, establishing a relationship with a banker can be beneficial for future financial needs.

12. Utilize Government and SBA Resources

Why It’s Important:

The Small Business Administration (SBA) and other government agencies offer programs that can help secure financing, especially for startups and businesses that might not qualify for traditional loans.

Steps to Take:

- Explore SBA Loans: These loans often come with favorable terms, including lower down payments and flexible overhead requirements.

- Check Eligibility for Government Grants: Research grants available for your type of business and industry.

- Use Government Advising Services: Take advantage of free advising services for small businesses provided by entities like SCORE and the Small Business Development Centers.

13. Review Your Legal and Tax Compliance

Why It’s Important:

Ensuring that your business is compliant with legal and tax regulations is critical. Lenders will be wary of any potential legal issues or tax liabilities that could impact your business’s ability to repay a loan.

Steps to Take:

- Audit Your Compliance: Conduct a thorough review of your business’s legal and tax standing to ensure everything is in order.

- Resolve Any Issues: Address any outstanding compliance issues, such as unpaid taxes or unfiled reports.

- Prepare Documentation: Have all relevant legal and tax documents readily available and organized for lender review.

14. Monitor and Adjust Your Financial Ratios

Why It’s Important:

Financial ratios are key indicators of your business’s financial health. Lenders often look at ratios like debt-to-income, quick ratio, or current ratio to determine the financial stability and creditworthiness of your business.

Steps to Take:

- Understand Key Ratios: Learn about the financial ratios most relevant to your industry and why they matter to lenders.

- Regular Monitoring: Keep track of these ratios regularly to understand the financial trends in your business.

- Make Adjustments: If certain ratios are suboptimal, take steps to adjust them, such as reducing unnecessary expenses or managing receivables more effectively.

15. Be Ready for Follow-up and Negotiation

Why It’s Important:

The loan application process doesn’t end with submission; lenders may require additional information, and there may be room to negotiate terms. Being prepared for these possibilities can influence the final terms of your loan favorably.

Steps to Take:

- Anticipate Additional Requests: Be prepared to quickly provide any additional information lenders may require.

- Understand Negotiable Terms: Know which aspects of your loan agreement can be negotiated, such as interest rates, repayment terms, or collateral requirements.

- Practice Negotiation Skills: Be ready to discuss terms confidently and clearly, aiming for conditions that better suit your business’s needs.

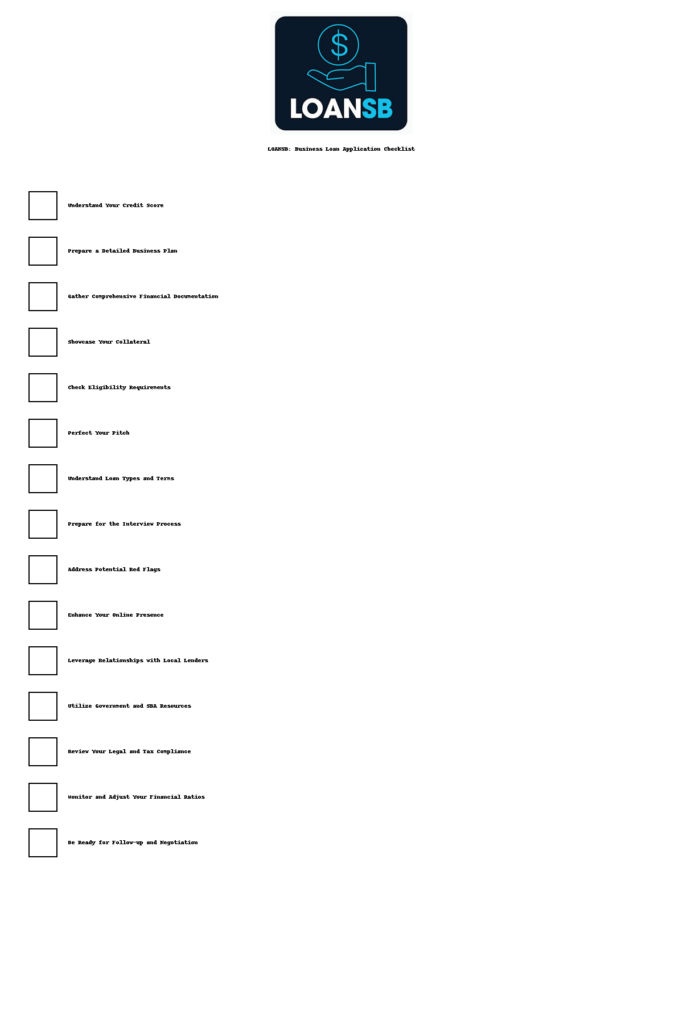

Printable Checklist

Please contact us if you have any feedback or questions.