Business Financing Options for Bad Credit

Securing financing for a small business can be challenging, especially for owners with bad credit. However, there are numerous options available that cater specifically to businesses in this situation. Whether you need funds for working capital, equipment purchases, or simply to manage cash flow, there are lenders and financial products designed to help. This guide provides an in-depth look at the various small business financing options available for those with bad credit, outlining their key features, benefits, and potential drawbacks. By understanding these options, you can make an informed decision that best suits your business needs and financial situation.

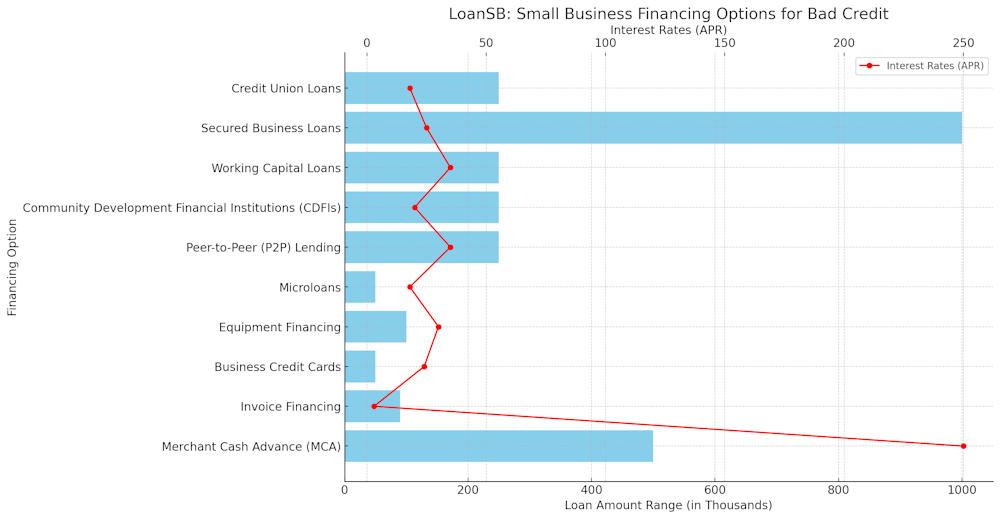

| Financing Option | Interest Rates (APR) | Loan Amount Range (Thousands) | Repayment Terms (Years) | Pros | Cons |

|---|---|---|---|---|---|

| Merchant Cash Advance (MCA) | 20% – 250% | $5,000 – $500,000 | Daily/weekly repayments | Fast approval, flexible payments | Very high costs, daily repayment can impact cash flow |

| Invoice Financing | 1% – 3% per month | Up to 90% of invoice value | When invoices are paid | Quick access to cash, based on invoices | Fees can add up, must have receivables |

| Business Credit Cards | 13% – 24% | $1,000 – $50,000 | Revolving | Builds credit, flexible spending | High interest rates, potential for debt |

| Equipment Financing | 8% – 30% | Up to 100% of equipment value | 1 – 5 years | Equipment as collateral, tax benefits | Can be costly, risk of equipment repossession |

| Microloans | 6% – 18% | $500 – $50,000 | Up to 6 years | Lower interest rates, available to startups | Smaller loan amounts, stringent eligibility |

| Peer-to-Peer (P2P) Lending | 7% – 35% | $1,000 – $250,000 | 1 – 5 years | Flexible terms, accessible to many | Higher interest rates, longer approval times |

| Community Development Financial Institutions (CDFIs) | 5% – 20% | $1,000 – $250,000 | 1 – 10 years | Supportive terms, community focus | Availability varies, longer process |

| Working Capital Loans | 10% – 35% | $5,000 – $250,000 | Up to 3 years | Quick funding, flexible use | Higher costs, short repayment terms |

| Secured Business Loans | 5% – 25% | $10,000 – $1,000,000 | 1 – 10 years | Lower interest rates, higher amounts | Risk of asset loss, more paperwork |

| Credit Union Loans | 5% – 18% | $1,000 – $250,000 | 1 – 7 years | Lower rates, personalized service | Membership required, smaller network |

Navigating the world of small business financing with bad credit can be daunting, but with the right information, you can find the solutions that work best for your business. From merchant cash advances to community development financial institutions, there are numerous pathways to secure the funds you need. While each option comes with its own set of pros and cons, understanding the details of each can help you mitigate risks and maximize benefits. Remember, improving your business’s financial health over time can also open doors to more favorable financing options in the future. With persistence and careful planning, you can secure the financing necessary to grow and sustain your small business, even with bad credit.

Please contact us if you have any feedback or questions.